Are Footfall Counter Systems Worth It? Types, Prices & ROI

Are Footfall Counter Systems Worth It? Types, Prices & ROI

For most bricks-and-mortar businesses, an accurate footfall counter pays for itself within months—provided you choose the right technology and actually act on the insights. A footfall counter system combines discreet hardware at the doorway with cloud analytics that records every entry, exit and movement pattern, turning raw visitor flow into actionable numbers.

This guide cuts through vendor jargon and marketing fluff. You’ll see how infrared beams, thermal sensors and AI-powered 3D cameras really stack up on accuracy and cost in 2025; what you should expect to pay for hardware, installation and ongoing licences; and how to translate counts into higher conversion, lower wage bills and safer spaces. We’ll run a clear ROI formula, highlight common pitfalls, and leave you with a practical checklist so you can invest with confidence—or walk away if the numbers don’t add up. By the end, you’ll know exactly whether a counter belongs on your budget sheet.

Footfall Counters Explained: Definition and Core Mechanics

Counting heads sounds simple, yet the technology behind a reliable footfall counter is anything but. Before comparing price tags, it pays to understand what the kit actually does and which numbers it feeds into your dashboards.

Definition & Basic Function

“Footfall” is retail shorthand for the number of people walking into a space; “people counting”, “traffic counting”, and even “crowd counting” are interchangeable labels you’ll see online. Regardless of wording, the core loop is identical:

- A sensor detects a body crossing an invisible line.

- The event is time-stamped and tagged as an entry or exit.

- Real-time software increments or decrements an occupancy register.

Because the tally updates continuously, you get live occupancy levels for safety compliance and historic totals for performance analysis.

Key Components: Sensors, Connectivity, Analytics Dashboard

A modern system bundles three layers:

- Sensor head – camera, infrared beam, thermal array or 3D stereo module plus a mounting bracket.

- Edge processor – sometimes built into the sensor for on-device AI.

- Power & network – PoE cable, Wi-Fi or 4/5G modem; choice affects installation time and cabling costs.

- Cloud or on-prem portal – delivers dashboards, alerts and API endpoints for POS or BI tools.

- Mobile app – quick health checks and live occupancy on the shop-floor.

The moment the sensor syncs, data streams securely to the analytics stack for visualisation and export.

What Data Do They Capture and Why It Matters

Beyond a simple door count, advanced systems harvest a richer set of metrics:

- Entrance counts & live occupancy – align staffing to real demand.

- Unique visitors – measure the reach of campaigns.

- Dwell time & visit duration – flag merchandising hot or cold zones.

- Returning rate – gauge loyalty programmes.

- Group counting – adapt tills or exhibits for families vs. solo shoppers.

- Demographics (age/sex bands) – refine product mix.

- Heatmaps & queue times – rearrange fixtures, prevent bottlenecks.

Each figure answers a different commercial question; together, they turn raw movement into actionable insight.

Why Footfall Data Matters to Modern Businesses

Traffic for traffic’s sake does nothing for the bottom line. The real value comes when the numbers are folded back into day-to-day decisions—how many staff to roster, which promotion to rerun, or whether that new seating area is earning its keep. That’s where a reliable footfall counter shifts from being a gadget to a profit lever.

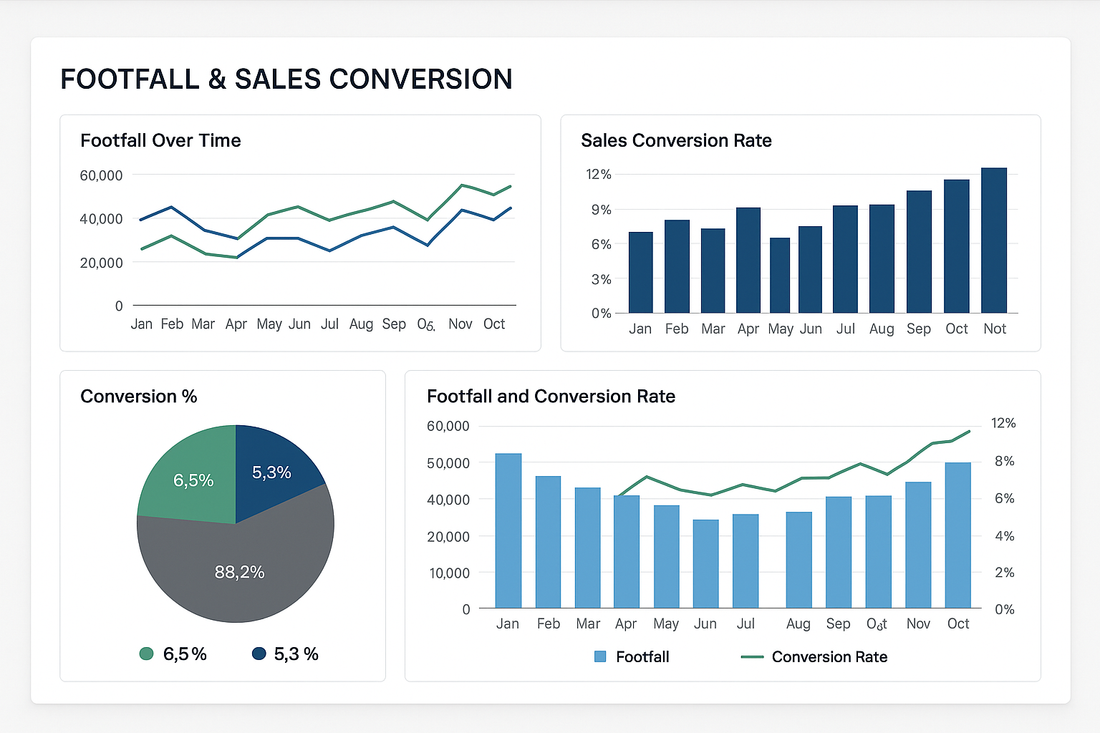

Boosting Sales & Conversion Rate

Pair visitor counts with your POS data, and you uncover the moments when curious browsers fail to become buyers. If a boutique logs 300 lunchtime visitors but only 60 transactions, its conversion rate sits at 60 ÷ 300 = 20 %. Knowing this, managers can test extra fitting-room staff or faster check-outs during that 12–2 pm spike and track the uplift daily. Even a modest two-point rise in conversion on 1,000 weekly visits equals 20 extra sales without a penny spent on advertising.

Optimising Staffing & Operations

Labour is often a retailer’s biggest controllable cost. Live occupancy feeds automated rota tools that trim quiet-hour overstaffing while flagging queues before they snowball. Chains using real-time alerts typically cut total labour hours by 5–10 % and save overtime premiums, yet still hit service-level targets because the workforce is aligned to actual footfall rather than guesswork.

Enhancing Layout, Space Utilisation & Safety Compliance

Heatmaps and dwell-time reports show where customers slow down, cluster, or simply walk past. Moving popular SKUs to under-visited corners can balance traffic and lift basket size, while live headcounts help venues cap occupancy for fire or health regulations at the push of a mobile notification. Fewer bottlenecks, happier customers, and no compliance fines—three wins from one dataset.

Proving Marketing & Leasing ROI

Campaign budgets and rent negotiations hinge on hard evidence. By comparing baseline footfall with promotion days, marketers can attribute in-store traffic uplift directly to a specific ad spend. Shopping centres armed with year-on-year visitor trends justify premium lease rates; pop-up brands can negotiate discounts if promised traffic fails to materialise. Everyone speaks the same language: verified counts.

Comparing Footfall Counter Technologies: Infrared to AI-Powered 3D

Not all counters are created equal. Accuracy, price and the type of insight you can extract vary widely depending on the sensing method. Below is a plain-English run-through of the five main technologies you’ll come across when shopping for a footfall counter in 2025.

Infrared Beam & Break-Beam Sensors

A low-cost transmitter shoots an invisible beam across the doorway; the device logs a count each time the beam is broken.

Typical price: £70 – £300 per doorway

Accuracy: 60 – 80 % in real-world use

Pros

- DIY battery install, no cabling required

- Works in total darkness

- Cheapest route to basic in/out numbers

Cons

- Can’t tell the direction unless you fit two beams

- Struggles when shoppers walk side-by-side or carry trolleys

- No extra metrics, such as dwell time

Best for one-entrance kiosks, public toilets or temporary pop-ups that need a ballpark visitor total.

Thermal & Time-of-Flight Sensors

These ceiling-mounted units detect heat signatures or measure depth to spot a human shape.

Typical price: £400 – £900

Accuracy: 80 – 90 %

Pros

- Reliable in low-light corridors and cinemas

- Better at ignoring shadows and merchandise than beams

- Modest install effort (PoE or Wi-Fi)

Cons

- Limited field of view; wide entrances need multiple units

- Can’t distinguish groups from individuals with high precision

Ideal for narrow, dimly lit passages in transport hubs or museums where camera privacy is a concern.

Overhead Video & 3D Stereo Vision (AI-Based)

Dual-lens or structured-light cameras build a 3D model of the scene and run onboard AI to classify each visitor.

Typical price: £1,000 – £2,500

Accuracy: 95 – 99 %

Pros

- Tracks direction, queue length, dwell time and even demographics

- Handles dense crowds and prams without double-counting

- GDPR-friendly when video is processed at the edge and instantly anonymised (e.g. Smart Urban Sensing 3DPro2)

Cons

- Needs stable lighting and a network drop (PoE preferred)

- Professional calibration is advisable to hit top accuracy

Go-to option for retailers chasing conversion insight, shopping malls, libraries and any venue that values rich analytics over lowest price.

Wi-Fi/Bluetooth & Mobile Tracking

Access points sniff anonymous probe requests from smartphones to estimate foot traffic, including pass-by counts outside the store.

Typical price: Software licence from £15 per month per node (hardware often reuses existing routers)

Accuracy: Highly variable; 30 – 70 % capture rate due to MAC randomisation

Pros

- Covers large areas with few devices

- Measures outside-to-inside “turn-in rate”

- No line-of-sight issues

Cons

- Reliant on visitors carrying phones with Wi-Fi enabled

- Privacy prompts and opt-out signage required under GDPR

- Unable to provide exact headcounts for safety compliance

Suited to pavement analytics, events and marketing attribution rather than occupancy control.

Multi-Sensor Hybrid Systems

Large venues increasingly mesh cameras, beams and Wi-Fi sniffers into one platform, using each sensor type where it shines.

Typical price: £10,000+ for a multi-entrance deployment

Accuracy: 95 %+ when properly calibrated

Pros

- Scales across whole malls, airports or stadiums

- Sensor redundancy keeps data flowing if one node fails

- Unified dashboard blends external traffic, queue times and in-store paths

Cons

- Complex project management and higher installation costs

- Data integration work is needed to avoid siloed reports

Choose a hybrid stack when you oversee dozens of entrances or must reconcile landlord, security and retailer data in one place.

How Much Do Footfall Counters Cost in 2025?

Sticker price is only half the story. A £99 beam sensor that needs weekly battery swaps can end up costing more than a mid-range thermal unit over five years, while a premium AI camera might be the cheapest route once you factor in labour savings and richer insight. Break the investment into four buckets before you sign anything.

Hardware Price Bands

| Technology | Typical Use-Case | Unit Price (2025) | Real-world Accuracy |

|---|---|---|---|

| Infrared beam | Single-door kiosks, toilets | £70 – £300 | 60–80 % |

| Thermal / ToF | Corridors, cinemas | £400 – £900 | 80–90 % |

| AI 3D video (e.g. 3DPro2) | Retail, malls, libraries | £1,000 – £2,500 | 98–99 % |

| Wi-Fi/BLE sniffers | Pavement, events | £150 – £400 (AP) | 30–70 %* |

*Capture rate depends on visitors’ phone settings.

Wider entrances or high ceilings (>4 m) often require two or more devices, so map every doorway before budgeting.

Installation & Network Infrastructure Costs

Professional fit-out in the UK averages £250–£400 per device, covering:

- Power or PoE outlet, cabling and containment

- Ceiling bracket or flush mount

- Ladder/lift hire and commissioning counts

Multi-site roll-outs enjoy economies of scale—expect 15–20 % lower day-rates once an installer knows your template.

Software & Analytics Subscription Fees

Most vendors run a SaaS model:

- Basic dashboard: £10–£20 per device/month

- Advanced BI, API or POS connector: +£10–£25

- Enterprise SLA or private cloud: bespoke, typically £5–10k per annum

Freemium options exist, but they rarely include data retention beyond 30 days or API access.

Total Cost of Ownership Snapshot

Five-year view for two common scenarios:

| Scenario | Devices | Up-front HW | Install | Software (5 yrs) | 5-yr TCO |

|---|---|---|---|---|---|

| 200 m² boutique (3 AI cameras) | 3 | £5,400 | £1,050 | £2,700 | £9,150 |

| 10-site chain, 4 doors each (40 AI cameras) | 40 | £72,000 | £10,000 | £28,800 | £110,800 |

The boutique needs roughly a 1 % uplift in annual sales to break even, while the chain spreads its licence discount and installation saving across all sites, lowering payback to well under a year when paired with staffing optimisation. Always run the numbers over the expected 5–7-year hardware life, not just year one.

Turning Counts into Cash: Calculating ROI

Traffic numbers in a dashboard are interesting; translated into money, they are powerful. The whole point of installing a footfall counter is to generate returns that dwarf the outlay—whether that is new revenue, trimmed costs or avoided penalties. To see if the business case stacks up, you need a structured way to turn visitor data into pounds and pence.

Core ROI Drivers

- Higher sales: lifting conversion, average basket or return-visit rate.

- Lower wage bill: smarter rotas, reduced overtime, fewer agency call-ins.

- Space monetisation: evidence for rent negotiations, pop-up fees, ad screens.

- Risk mitigation: avoiding fire-code fines and reputational damage through live occupancy alarms.

Most projects end up with a blend of two or three drivers; write them down before you start crunching numbers.

Step-by-Step ROI Formula with Worked Example

Use the classic payback formula:

ROI (%) = (Annual Financial Benefit − Total Cost) / Total Cost × 100

Worked example – 200 m² fashion boutique, three AI 3D cameras:

- Total 5-year cost (from earlier table): £9,150

- Projected benefits

- Conversion uplift: +2 pp on 100 daily transactions worth £45 each = £32,850/year

- Labour saving: 6 hours/week at £12/hour = £3,744/year

- Compliance peace-of-mind: valued at £1,000/year (avoided fines/insurance hikes)

Annual benefit = £37,594

ROI over five years:

ROI = (37,594 × 5 − 9,150) / 9,150 × 100 ≈ 1950 %

Payback period = 9,150 ÷ 37,594 ≈ 0.24 years, or under three months.

Typical Payback Periods by Sector

| Sector | Common Use-Case | Payback Window |

|---|---|---|

| Fashion & speciality retail | Conversion + staffing | 3–9 months |

| Quick-service restaurants | Queue alerts + labour | 4–6 months |

| Museums & galleries | Funding metrics + safety | 6–12 months |

| Offices/Facilities | Compliance only | 12-plus months |

Common ROI Killers to Watch

- Poor sensor placement driving low accuracy and mistrust.

- Data siloed from POS or workforce planning tools.

- Front-line staff never trained to act on the insights.

- Over-specifying hardware (e.g., 4K cameras in a quiet corridor).

- Ignoring ongoing licence fees when pitching the business case.

Avoid these traps and your footfall counter won’t just count visitors—it will count towards profit.

Buying Guide and Implementation Checklist

Most procurement headaches arise because the team rushes into hardware selection before agreeing what success looks like. The four-step checklist below keeps the project grounded in outcomes, not gizmos, and will stop you paying twice for the same insight.

Define Business Objectives & KPIs Upfront

Start by writing a one-sentence goal: “Reduce queue abandonment by 20 % within six months,” for example. From that, choose the metrics that matter—live occupancy, average queue time, staff-to-visitor ratio, conversion rate.

Next, walk the site with a tape measure and a camera: note entrance width, ceiling height, lighting quirks, existing power/network points and any obstructions such as hanging signs. A quick audit spreadsheet will tell you how many sensors you need and whether PoE cabling or Wi-Fi repeaters are required. Clear, numeric KPIs plus a site map become your reference point when comparing quotes.

Questions to Ask Potential Vendors

- What accuracy do you contractually guarantee at my ceiling height?

- How is data anonymised to meet GDPR—edge masking, no storage, or both?

- Is there an open REST or MQTT API for POS, BI or roster software?

- Can the platform handle multi-site hierarchies and user permissions?

- What is the hardware warranty term and replacement SLA?

- Do you offer remote health monitoring and automatic firmware updates?

Use Smart Urban Sensing’s privacy-first AI, open API and industry-specific dashboards as a yardstick. Any supplier ducking these questions is a red flag.

Installation & Calibration Best Practices

Even the best sensor will miscount if it is off by a few degrees. Budget for a professional site survey, especially for high ceilings or angled entrances. Key tips:

- Mount directly above the traffic line; avoid tilting across thresholds.

- Run a 30-minute manual count during commissioning and match it to the dashboard; adjust zones until variance is <3 %.

- Schedule a re-calibration every six months or after shop-fit changes.

Remote commissioning can trim costs for simple single-door installs, but on-site alignment pays dividends in busy multi-entrance venues.

Adoption, Training & Continuous Improvement

Tech only earns its keep when front-line staff act on the alerts. Create role-based dashboards: store managers see conversion, security sees occupancy alarms, marketing sees campaign uplift. Hold a 15-minute traffic review each week to spot anomalies and set micro-tests—moving signage, tweaking break patterns, A/B merchandising layouts.

As insights prove their worth, expand the deployment across the estate and feed the API into corporate BI tools for chain-wide benchmarking. Continuous iteration, not one-off reports, is how a footfall counter turns into a silent member of the management team.

FAQ: Quick Answers to Common Footfall Counter Queries

Below are the questions that crop up most often when managers weigh up a new footfall counter. Scan them, get the facts, move on with confidence.

What is a footfall counter and how does it differ from a people counter?

In practice, the two terms are interchangeable. Both describe hardware + software that registers every person entering or exiting a space. A few vendors use “people counter” for multi-zone, in-venue tracking and “footfall counter” just for doorway counts, but the technology underneath is identical.

How accurate are footfall counters?

Accuracy hinges on sensor type, placement and crowd density. Expect 60–80 % from budget infrared beams, 80–90 % from thermal/time-of-flight units, and 98–99 % from AI-driven 3D cameras such as Smart Urban Sensing’s 3DPro2. Poor mounting angles or glass reflections can knock any device off-course, so calibration is critical.

Are footfall counters GDPR compliant?

Yes—provided the supplier anonymises data at source. The gold standard is edge processing that masks faces and never stores raw video. Look for on-device encryption, ISO-certified data centres and clear opt-out procedures. Avoid systems that upload identifiable footage without explicit consent.

How do I calculate my store’s footfall ratio?

Divide transactions by visitor count for the same period:Footfall ratio (conversion) = number of sales ÷ number of visitors.

If you processed 120 sales from 800 visitors yesterday, your conversion rate is 120 ÷ 800 = 15 %. Track this daily to spot staffing or merchandising wins.

Can I install a footfall counter myself?

DIY works for single-beam units—stick them at waist height and swap batteries every few months. Multi-entrance, networked AI systems really need a professional survey and PoE cabling. Skimping on install costs often ends up pricier when miscounts force a re-fit.

Key Takeaways Before You Invest

A footfall counter is only “worth it” when the technology, price and action plan line up with your real-world goals. Use the following cheat sheet to sanity-check any proposal before signing the purchase order:

- Match the sensor to the question: infrared for rough head-counts, AI 3D for conversion and staffing insight, Wi-Fi sniffers for pavement traffic.

- Budget for the full five-year TCO—hardware, install, licences and periodic recalibration—not just the upfront box price.

- Demand a documented accuracy guarantee and GDPR-proof anonymisation; anything vague will bite you later.

- Build a routine around the data: weekly KPI reviews, role-based dashboards and experiments that translate numbers into pounds.

Nail these four points, and your counter should repay itself in months rather than years. Ready to see the maths for your site? Book a live demo with Smart Urban Sensing today.